ECSPR

ECSPR Monitor 9: Insights from ECSPR Licensing Trends

Our research on the 2023 data regarding ECSPR-licensed platforms offers intriguing insights into the adoption of the new law by existing market participants. While it doesn't allow for conclusions regarding individual platform motivations and levels of professionalism, it does reveal disparities between national markets.

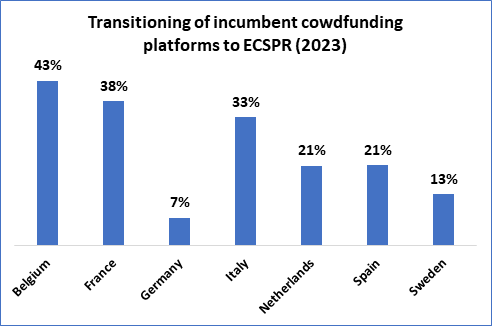

The graph below provides a comprehensive overview of the licensing status across key EU member states, drawing from data on 106 platforms licensed by the end of 2023 as per ESMA data at the time.

Notably, our focus was on countries with robust trading markets, including Belgium, France, Germany, Italy, the Netherlands, Spain, and Sweden. We utilized data from the recent research study "The European Crowdfunding Market Report 2023" by LenderKit, CrowdSpace, and UiA, which serves as a simple benchmark for the size of the incumbent pre-ECSPR crowdfunding market.

For instance, at the end of 2023 Belgium and France had licensing rates of 43% and 38% respectively, while Germany only reached 7% of its incumbent platforms licensed under ECSPR. Italy and the Netherlands fared slightly better but still lagged, with rates of 33% and 21% respectively, while Spain and Sweden reached licensing rates of 21% and 13% respectively.

A clear trend emerges: the majority of countries reviewed have less than half of their active incumbent platforms licensed under ECSPR, indicating a significant portion operating without professional regulatory oversight or potentially having disappeared from the market. We can also assume that markets with lower transition numbers might catch up in early 2024, with several applications not having been granted at the time or not published by ESMA.

A significant number of platforms were surely still awaiting their license, despite the law being published in 2020 and applicable since 2021, indicating a disregard for professional conduct within the market to some degree. The first ECSPR license was issued to an incumbent platform in Spring 2022, six months after the law entered into force. The lack of uptake is surprising; ECSPR represents a significant step towards improved legal oversight, consumer protection, and prudent business conduct.

However, the delayed uptake should of course be partly attributed to legal uncertainties, at least in 2021 and 2022 when ESMA and EBA had clarified outstanding technical standards, and more significantly to delays in adequate conduct by national competent authorities. Our data does not provide answers as to the reason for the delayed uptake, and while anecdotal evidence is aflush, we refrain from using it here.

In conclusion, there is a clear need for continued efforts by ESMA to improve compliance levels and ensure that all European platforms offering securities and loans have obtained an ECSPR license. Compliance is crucial for a transparent, lawful, and secure environment that protects the interests of all stakeholders, including platforms, investors, and project managers.

Significant work by competent authorities is required to strengthen regulatory convergence and enhance strict oversight to ensure a harmonised application of the law across the European crowdfunding landscape. We therefore welcome the latest efforts by ESMA in seeking to establish a level playing field.