ECSPR

ECSPR Monitor 5: A paradigm shift for the Crowdfunding sector

On 10 November 2023, the European Crowdfunding Service Provider Regulation for Business has finally come fully into force, without exemptions. EUROCROWD is very happy to have been able to provide such decisive input into this law, jointly with our members, and to now work with regulatory authorities and the leading crowdfunding service providers to ensure a smooth and professional rollout of this new market. This coincides with a lackluster development of the European Capital Market Union, as per AFME and partner organizations. New regulations around crypto assets or open finance will likely increase the competitive pressure in the future, and we will monitor the development of the crowdfunding sector closely.

In the rapidly evolving landscape of European crowdfunding, over 90 licenses had been granted as of 10 November 2023, with more licenses pending (at the time of publication the number of licensed firms has risen to more than 110 according to ESMA, which will provide easier and more up to date access to the data as of January 2024). We anticipate more licenses over the coming months, prompting concerns about how not-yet-licensed Crowdfunding Service Providers (CSPs) can sustain cash flow during the waiting period. New regulations around crypto assets or open finance will likely increase the competitive pressure in the future.

It is noteworthy, that France currently leads with the highest number of licenses granted, an interesting development considering initial challenges in meeting deadlines, resulting in lobbying efforts by the French market and authorities to extend the transition period. The Netherlands, while following France closely with regard to licenses, asserted during the negotiations of the law that a handful of CSPs would likely suffice for the size of their local market. For now, regulatory competition is highly concentrated, with 50% of platforms registered in just three countries on 10 November 2023 and four countries (France, Netherlands, Spain, and Lithuania) as per the current list.

The competitive landscape amongst the member states aligns at first with the spirit of the European Crowdfunding Service Providers Regulation (ECSPR), which encourages competition among member states for attractiveness. Notably, Germany, despite being the largest economy in the EU, has failed to converge its crowdfunding sector into a professional EU-wide licensing opportunity. The current distribution of CSPs by country is likely not representative of overall market conditions and so far, most CSPs have been highly resistant to the idea of shopping for licenses, likely also being discouraged by member state authorities and legal advisers, who consider this unwelcome based on their experience with other European directives, such as MiFID.

The current distribution of platforms by member states, other than Germany, largely reflects the previous status quo, though on a smaller scale. The number of platforms seeking cross-border business is also rather small for now. But as the European crowdfunding market will likely reach the EUR 1 billion mark for 2023 (ECSPR only), a pivotal question arises: Can 110 CSPs thrive in this space, or will market forces lead to a contraction in the number of CSPs over the next 3 to 5 years? It remains likely, that some member states will turn out to be more attractive than others going forward, though it is likely given both, the proactive engagement of some NCA and member states specific capital market environment, that will dictate which markets will be core markets for CSPs.

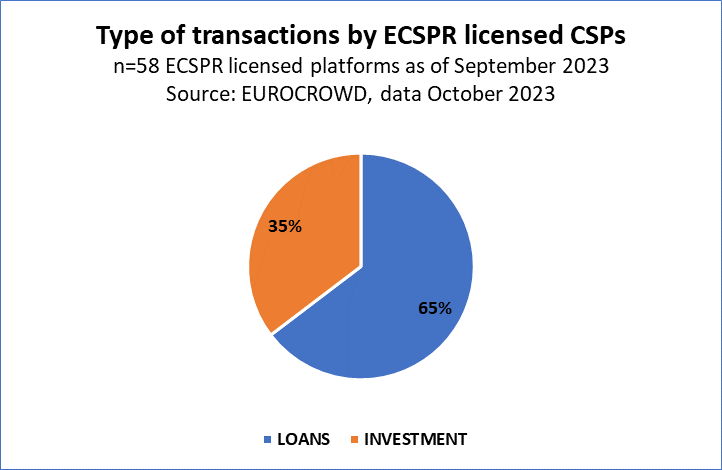

Looking at the 58 ECSPR licensed CSPs as of September and viewing their transaction volumes and values in 2023 until October, we captured a total of 1.296 transactions with a value of EUR 615.98 million. The data can only be indicative and should not be taken as a total, as our data collection relied on public information only. Still, by volume, we see more lending activity than investment, though we remain careful even here as the presentation of data on CSPs platforms does not always clearly allow for differences in transactions licensing relations. In many cases the CSPs fail altogether to showcase the relevant licensing regime under which transactions have been executed, a violation of the ECSPR consumer protection requirements and hopefully to be enforced by NCAs in the mid-term.

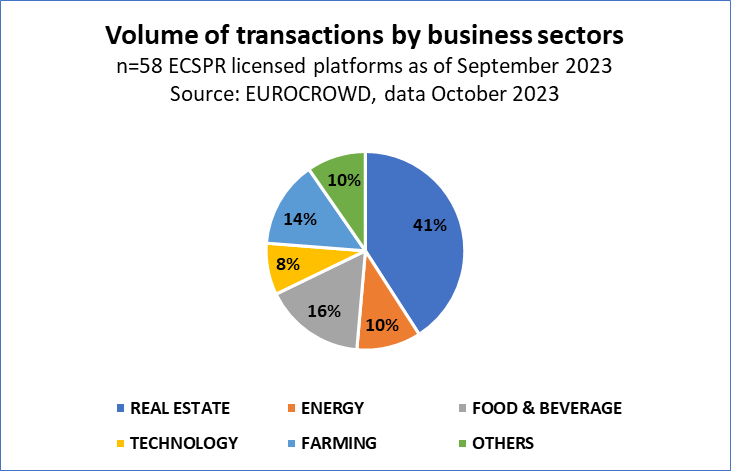

The distribution of transactions across business sectors, shows a large part in the real estate sector, with sectors such as technology, energy, food & beverages, or farming are all representing a similar share. As the data universe available for this overview is randomly biased by the licensing process of 27 national competent authorities as well as the speed with which wannabe CSPs have applied, any interpretation of the data would likely fail to deliver meaningful results for the total market. We will have to see full market data within the next year.

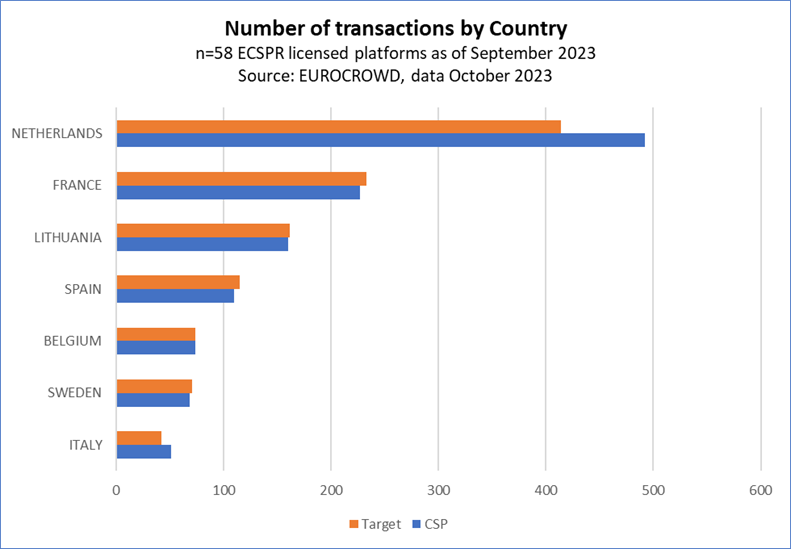

The transaction and the location of the CSP show that in general cross border activity is limited. Exceptions are few, and like in the Netherlands, can be pinpointed to individual CSPs with a business model of financing projects outside of the EU.

Licensing and establishing a home market, however, has been only the first hurdle. The sector is at a crossroads even more than before, balancing regulatory developments, national dynamics, and the overarching goal of sustainable growth. Without scale in the market, which again in many cases can only come from cross-border activities, the number of licensed CSPs is likely to shrink again over the next few years. Add to this increasing compliance cost with additional EU regulation likely or for sure to be applied to ECSPR over the next years, for example, DORA, AML, or FIDA, and the increasing pressure to professionalise and scale will dictate success in many cases. We can assume that such developments will also be supported by more established market actors, increasing barriers to entry as the market develops.

The pending impact assessment of the regulation and market by the European Commission, as well as the input of the European Securities and Market Authorities, will likely play a pivotal role in shaping the future of the sector. It is in this light, that the 12th European Crowdfunding Convention in Milan gathered around 80 participants, representing six active national competent authorities and the majority of European market share by volume and value for transactions.

The professionalisation of the crowdfunding sector, increasing consumer protection, scalability, and the ability to serve specialised niche markets will be key drivers for successful platforms. The expression of NCA at our Milan Convention, that it is time for authorities to more closely look at licensed platforms and their compliance with relevant provisions in the law can only be seen as a hallmark for the expectations of a harmonised segment within the European Capital Market Union. What the ECSPR market will have to do over the next years, is to proactively seek collaboration establishing relevant interpretations of the rules, ideally in discourse with competent authorities’ regulatory convergence efforts to limit the need to establish costly case law examples. EUROCROWD and its members are proud to have established an early discourse in advancing the design of the future application of the law in cooperation with relevant authorities and we will welcome any relevant party to join ongoing and future discussions.