ECSPR

ECSPR Monitor 2 – ESMA Register, June 2023

In our first ECSPR Monitor from May 2023, we looked at how licensed ECSPR crowdfunding service providers dealt with licensing requirements and transparency aspects on their websites. Only two-thirds of the KPI we reviewed were complied with, not surprisingly at this stage, yet unsatisfactory nonetheless. This time we are looking at ECSPR-licensed platforms and their legal compliance as published by ESMA.

With EU law, crowdfunding service providers (CSP) must inform their national competent authority (NCA) of several KPIs as laid out in the legal text (Art 12) and confirmed by ESMA in the technical standards under the European Crowdfunding Service Providers for Business Regulation (ECSPR). Without the provision of these, CSP cannot obtain a license. Once the CSP provides said KPI, the NCA informs ESMA (Art. 12(9)), which is under a legal obligation (Art 14) to publish in a public register of crowdfunding platforms. We must therefore trust the flow of information which originates from any CSP, foresees an NCA managing the data provided, and ESMA publishing it.

The ESMA register of crowdfunding service providers is therefore the only official public database of licensed crowdfunding platforms that can provide direct investment or loans to businesses in Europe, one and a half years after the law has entered into force. It has a significant role to play in consumer protection and transparency, as it is the final go-to for any retail investor when considering an investment via a CSP – should retail investors have an interest in doing so.

When reviewing the ESMA website and its information on ECSPR, specifically the register, we however found significant concerns regarding the representation and accessibility of data. We asked ESMA for clarification, which provided relevant information alleviating our concerns. Therefore, we will not report on those issues that ESMA provided reasonable clarification for, but we can state that ESMA seeks to offer access to ECSPR-related information through two parts on its website.

First, ESMA lists its ECSPR-related activities in its dropdown menu under ESMA’s Activities -> Investors and Issuers -> Investment Services where the user than can find a description of ESMA’s role and a list of the related areas. Under the ECSPR link further information is being provided and a link to the ESMA Library with the search word “crowdfunding” opens, where all past communication and documentation can be found.

A second access point is via the “Publications & Data” tab, which opens a page with a list of databases published by ESMA. Under “Crowdfunding (ECSPR)” the user finds the link to the register of crowdfunding service providers.

ESMAs website currently offers several additional access points to reach ECSPR relevant information, however, a number of these are outdated and no longer linked to from the home page, though searchable. They will hopefully be removed soon.

Interesting for the crowdfunding sector should be, that ESMA has different categories into which it separates its work. Crowdfunding finds itself under “Investment Services”, next to, for example, the Markets in Financial Instruments Directive/Regulation (MiFID/MiFIR) and the prudential framework for investment firms. Crowdfunding does not feature, however, under “Digital Finance and Innovation”, something that we see many CSPs aim to be seen as. Within ESMA this area is so far reserved for crypto assets under the just published Markets in Crypto-Asset Regulation (MiCA). Crowdfunding is therefore, and maybe not surprising, considered a non-digital and non-innovative traditional financial service.

Going back to the ESMAs register of crowdfunding service providers linked under “Publications & Data”, the user will find a link to a highly inaccessible spreadsheet. And while ESMA has the favor of publishing all sorts of registers and information in downloadable formats, this one is particularly hard to operate. ESMA confirmed to EUROCROWD that it is currently working on the implementation of a tool that should provide automatised notifications by NCAs to ESMA. According to ESMA, this should also improve the quality and readability of the output and should work similarly to the one for MiFID firms. The current Excel spreadsheet the user encounters today may therefore be considered a temporary solution. It intends to provide material information only.

The register will be published by ESMA and is published by ESMA, but the information within has been provided by the NCA directly without ESMA editing the input. The information is such as set out within ECSPR, specifically, it lists information as required by ECSPR within Art. 14(2) and Article 18(1) (b) and (c). In other words, the “Name, Legal form, Legal identifier (if applicable), Commercial name of the platform, Physical address, the Internet address of platform, Crowdfunding service for which the CSP is authorised, Any penalties imposed on the CSP, Any penalties imposed on the managers, Name of NCA, Address of NCA, List of Member States where CSP intends to provide services, Any other service provided by the CSP, Member State, identity of the natural and legal persons responsible for the provision of crowdfunding services, and starting date of intended provision of services by the CSP” of every ECSPR license holder that has received a relevant license by any given NCA, and that has been communicated and finally published by ESMA.

Anecdotal evidence reveals that a good number of months may pass from the granting of a license by an NCA to the official publication on the Register by ESMA. And at the time of accessing the spreadsheet, less than six months until the transition period ends for those crowdfunding platforms that are already operating and licensed under national rules, we found 38 entries, one of which was a double entry. For the 37 licensed platforms registered in the spreadsheet, we initially find all the information required and can form a relevant picture of the market. However, in its current format, the register is very difficult.

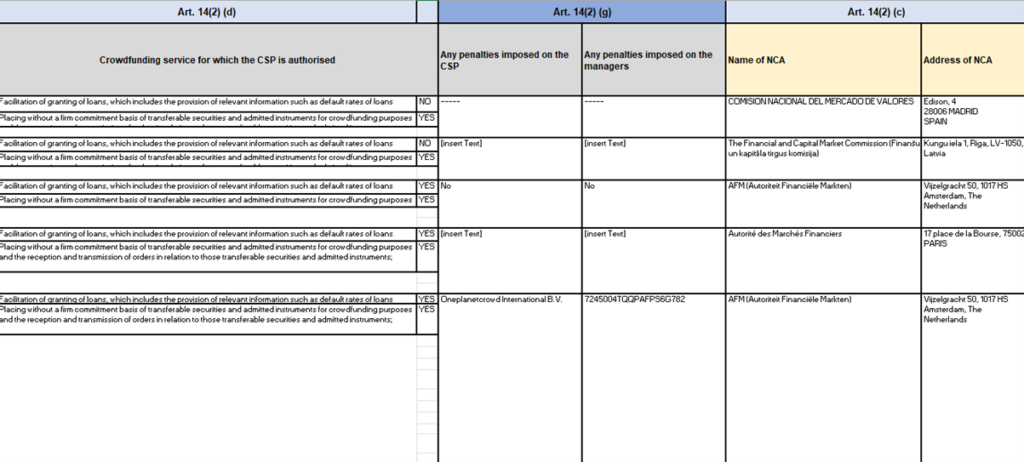

Notwithstanding the presence of all required information, at a closer reading, we find that data entries are not only inconsistent in format but in one case they are also misreported by the relevant NCA and published by ESMA. In most cases, however, the non-uniform answers provided by NCA are initially confusing but don’t represent a material change.

More specifically for example, in the same column “I” answering the same question –Art. 14(2) (g) penalties imposed – we are confronted with three different entries: “…..”, “[Insert Text]”, and “No”, all appearing within the first three rows. Such inconsistency generates a confusing situation for the general reader as each of the entries represents quite a difference in meaning.

A potentially more serious example is the one provided in row 112. In the column “I” Any penalties imposed on the CSP we read Oneplanetcrowd International B.V., while in column “J” Any penalties imposed on the managers we read 7245004TQQPAFPS6G782. It is clearly a mistake, as the data entered is duplicated from columns “A” Name and “C” Legal Identifier. But the reputational repercussions in such a case – given relevant circumstances – could in the worst case result in a legal business defamation claim against ESMA and the NCA. For now, the reader either can put this away as a simple mistake, decide not to trust the Register for accuracy, or to carry a doubt about the CSP listed in row 112.

We also find entries in rows 436 and 706 to be for the same organisation. Did they apply for two ECSPR licenses? The only difference in entries seems to Art. 14(2) (e) List of Member States where CSP intends to provide services, and in relation to that Art. 18(1) (b) and (c). But does the entity indeed hold two licenses? Or is the second entry an update to the first? There is no indication for the reader to differentiate and readability of the Register will suffer greatly if all updates are entered as separate entries.

Under Art. 14(2) (f) “Any other service provided by CSP”, the regulation establishes the requirement to report “any other services provided by the crowdfunding service provider not covered by this Regulation with a reference to the relevant Union or national law. Examining the Register, we find a few platforms that intend to offer specific services within ECSPR such as a bulletin board or special purpose vehicles. However, only two of the registered CSP answered by providing additional details under “Other”, referring to national licenses as those for placement agents in one case, and to MiFID and the existing national crowdfunding license in the other.

In our first ECSPR Monitor, we found that at the time 17 CSP promoted other such services on their website, but only one had added this fact to their license application. In theory, every CSP that holds a national crowdfunding license, brokerage, or placement agent license still after their ECSPR license has been applied for, should have registered this piece of information here. The same applies to any additional EU license - ESMA even clarified this specifically for MiFID within their Q&A. This is not a point that ESMA needs to review, but it nevertheless remains a clear weakness in their public Register. It results from a lacklustre licensing process by NCA who do not verify the information provided – and by CSPs that do not update their public appearance accordingly. Given that CSP have one year until an NCA will review their compliance, retail investors might be subject to wrong information during this period by both ESMA and CSP alike.

Information provided in columns “P”, “Q” and “R” relating to Art. 18 within the Register only concern CSP offering “cross-border provision of crowdfunding services”. Whereas “cross-border” has not been defined in the law specifically, nor in the ESMA RTS or Q&A, the recital clearly states the intent to create a smooth and functioning cross-border crowdfunding market. We understand that “cross-border” in this context relates to the definition of services provided under ECSPR, i.e., either the facilitation of granting of loans or the placing of tradeable securities and admitted instruments, and where a CSP indicates that it will pro-actively and according to national marketing and consumer protection law aim to offer loans or investments in the Member States other than its home market. The Register, therefore, does not provide any information about CSPs accepting investors or projects from other member states through reverse marketing and does not capture communication or business activities falling outside this definition and especially not if done in languages not accepted by individual NCAs, such as English in many cases.

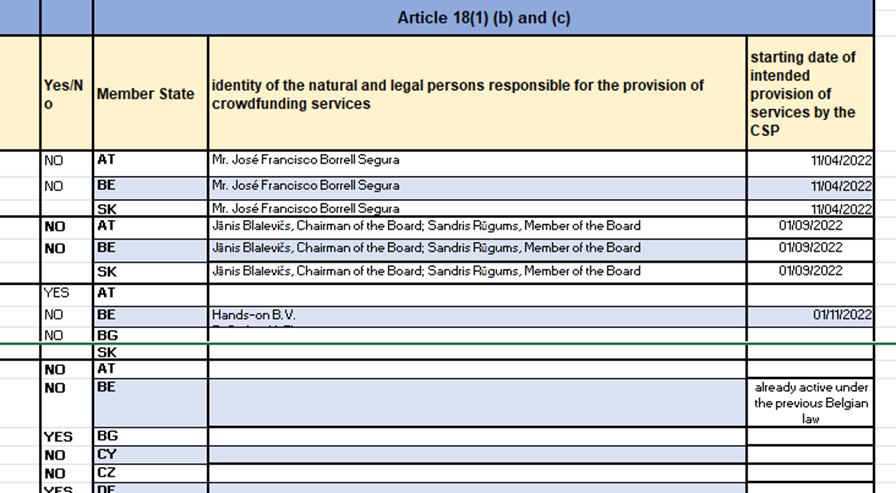

Regarding Art. 18 the Register provides an indication of member the state where the CSP seeks to provide services in column “P” (copied from column “M” under Art. 14). In column “R” the identity of the natural and legal persons responsible for the provision of crowdfunding services in each member state is presented and the estimated starting date of the service provision by the CSP for each member state in column “S”.

Column “R” (identity of the natural and legal persons responsible for the provision of crowdfunding services) identifies natural and legal persons liable for those CSP that indicate active marketing in member states other than their home state. This refers to what we outlined above as “cross-border” activities. The Register however lists the identity of the natural and legal persons for both, CSPs with indicated “cross-border” activities and those without. At the same time, not all CSPs without “cross-border” activity provide information under column “R”.

We are now left with some entries left blank in column “R”. If column “A” Name would refer to the identity of the natural and legal persons responsible for the provision of crowdfunding services as asked in column “R” in the home member state, indeed the information in row “R” could be left empty. But already with the first entries indicating cross-border activity under Art. 18 within columns “P”, “Q”, and “R”, CSPs have entered different natural and legal persons in column “R” then the entity named under column “A” also for their home market. We are therefore left with some entries without the provision of the natural and legal persons.

Column “S” starting date of intended provision of services by the CSP indicates the starting date specifically only for those CSP that have entered information in column “R” identity of the natural and legal persons responsible for the provision of crowdfunding services. We therefore can identify the starting date of the ESCPR services by CSP by country individually. NCAs will review if these activities are taking place after one year from the granting of the license. Whether the starting date is equivalent to the licensing date within the home market remains open. Interestingly, one NCA has granted a CSP a starting date preceding ECSPR by providing in column “S” the entry “already active under the previous Belgian law”. Surely, an interesting anecdote, but it remains unclear why NCA believed this should be entered here when the column clearly asks for the starting date of ECSP services.

Looking at the above details, and considering we removed parts of our review due to our communication with ESMA on the issues, we overall hope for a quick update of the presentation of the Register of crowdfunding service providers and an improvement of the information provided by, at least some, NCA. For retail investors, who are the main beneficiaries of ECSP in being able to execute direct investments and loan provisions to SME across the EU, the Register published by ESMA, which by law should be the trustworthy reference on this newly regulated market activity, is likely of little to no use. Instead, it rather points towards a certain disinterest by the entities involved and might, going forward, raise concern about the knowledge of NCAs in overseeing crowdfunding. But it also leaves a mark on the CSP themselves, who are ultimately submitting information to the NCA.

The Register is a good first effort at creating transparency, but it falls short in the quality of information and accessibility for now. ESMA has committed to improving its work and being aware of certain shortcomings, however, verification or review of data submitted is not on its list. We hope that ESMA can instead facilitate stronger cooperation amongst NCA in how to provide reporting under ECSPR. Only if NCA have a full grasp on the needed requirements themselves, end users may trust them to supervise CSPs and to trust a young financial services market such as crowdfunding.