ECSPR

ECSPR Monitor 3 – Regulatory competition, August 2023

Over the past months we have looked at the different historical developments of crowdfunding across the EU and the different avenues of Member States have chosen in approaching the market and the new EU legislation. There are significant variations in the approaches of different Member State authorities, and we believe it is undisputable, for now, that the national view prevails over a harmonised EU approach. The differences between individual Member State approaches are continuing to be detrimental to what we believe the intention of ECSPR has been.

As the complexities of cross-border transactions by CSP will increase, NCAs will need to help clarify many unanswered questions raised by the market and legal experts. From our limited experience, we remain highly doubtful that the majority of NCAs are set up and prepared for what the market might expect. For now, anecdotal evidence suggests that the majority of NCAs are not able to adequately guide the sector nor help the economy at large in accessing funding.

We believe the goal of ECSPR was to create a unified set of rules relevant to crowdfunding services provision throughout the EU and that it should lead to uniform requirements regarding the provision of crowdfunding services and operating crowdfunding platforms; operating, authorising, and supervising CSPs; as well as transparency and marketing communications relating to crowdfunding services in the EU. It seems clear to anybody involved in the market, that this has not been achieved and a brand new study commissioned by EUROCROWD with PwC Legal details this country by country, “Crowdfunding in the EU Key Legal, Regulatory and Tax issues ”.

For now, individual EU Member States are still seeking to fit the new EU law into their own national legislation and common, national understanding and interpretation of capital market rules. The differences in treating ECSPR on a national level in all aspects where Member States have been granted freedom of interpretation is already now leading toward undue disruption instead of potential harmonisation. Member States do not seem to consider opportunities within ESMA for knowledge exchange and more stringent efforts to ensure consistency and harmonisation. The input provided by both EBA and ESMA within the RTS has not sufficiently helped harmonising national approaches further. However, the text always left room for regulatory competition.

There are interpretations of certain articles by some Member States that may very well oppose the legal text published by the European lawmakers. The unwillingness, be it unintentional or intentional, of Member States to apply the legal text as it seemingly was intended is likely to create additional hurdles and constraints for a developing market. But the restrictive interpretation by some Member States in their national implementation of ECSPR has also created opportunities to exploit regulatory competition.

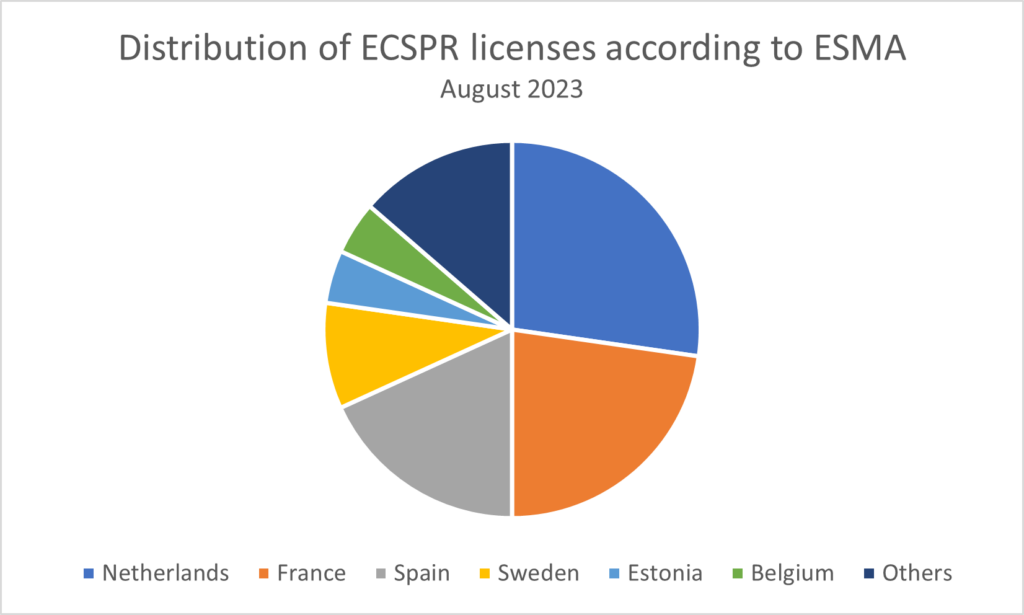

We are already seeing now the first fruits of regulatory competition about the number of licenses issued by Member State. ESMA lists a total of 44 entries, 12 CSPs for the Netherlands, 10 for France and 8 for Spain. In comparison, there is 1 listing for Germany and none for Italy, two of Europe’s larges economies and previously active crowdfunding markets. Sweden clocks in with 4, Estonia and Belgium with 2 each However, it remains to be seen if these markets will also offer the best operating conditions in the long run. Especially as new regulations, such as MiCAR, are adding new layers of complexity and further opportunities for regulatory arbitrage.

With the EC, ESMA and EBA not having been able to clearly guide harmonisation, and some Member States, such as Hungary, already goldplating the new law within their implementation – or others, such as Germany and Italy by delaying a meaningful transition within their political systems – we remain unsure if ECSPR will be able to have a broader impact on the European economy across Member States or if it will be confined to a small number of Member States more open to financial market innovation.

But we also believe that it will take time and a strong, scaling, and professional market to incentivise some if not most NCAs to deliver on these needs. There is however no evidence yet of significant uptake regarding transactions under ECSPR from the market. CSPs have delayed the adoption of ECSPR over the past years, with some showing significant resistance to understanding the new rules. Paired with the capital needs for adopting their business to ECSPR, the uncertainty provided by NCA is leading toward an expected exodus of a large part of market participants.

This new reality is exciting, even though for some it might be painful, and will lead to new opportunities for growth and competition. We are looking forward to a changed market and will discuss this with the professional crowdfunding sector on 15 & 16 November 2023 during our 12th European Crowdfunding Convention “Ready, Set, Restart: New crowdfunding scenarios ” in Milan, Italy.

[1] Note, the correctness of the ESMA list remains disputable as there are entries that have no NCA listed but are said to have received a CSP license – see also our second ECSPR Monitor here for other issues