ECSPR

ECSPR Monitor 8: Early fee structures in ECSPR services

To better understand how crowdfunding platforms generate revenue from their services, we reviewed self-reported public data of all ECSPR licensed crowdfunding service providers listed by the European Securities and Market Authorities (ESMA) by the end of 2023. Of those, we were able to collect reference Data from 44 platforms. The data provides an initial insight into the current business models. We only capture data from crowdfunding platforms charging fees as a percentage of capital cost or of transaction cost. Platforms charging fixed fees have been excluded. In general, the data of fixed fees was insufficient. We cannot exclude that additional fees are being charged by platforms.

Crowdfunding platforms, like any other business, require a solid revenue structure to remain operational. To achieve this, platforms establish a scheme of costs and commissions that are imposed on the different actors involved in project financing transactions. As crowdfunding platforms are not allowed to participate in transactions as co-investors, but only to broker the transactions, their fee structures are vital for revenue generation. Platforms can charge commissions and fees to both investors and project owners seeking financing. Platforms may also charge additional fees for providing evaluation, advisory, and management services to project owners.

Fees applied to project managers are in general commissions for the inclusion of the project or commissions for the closing of the fundraising. Specifically, for the inclusion of the project we find the average fee to be 5.8% of capital and for the closing commissions the average to be 3.95% of capital raised. Both fees in general are earned with the conclusion of a successful fundraising. Fee structures that have fixed fees rather than a percentage are not included in this calculation as for most no reliable data could be collected, they however do exist for now. Overall loan-based crowdfunding platforms do not openly charge fees for the inclusion of a project, while investment-based platforms do.

Average fees charged to Project Owners as % of capital:

- for inclusion (Project Owner); 5.80%

- Closing (Project Owner); 3.95%

Alternatively, platforms also apply commissions to investors, which are associated with the return on investment or administrative activities. These include the purchase and sale of shares or bonds, or cover costs related to payments and money management as well as registration on the platform. The costs for return on investment are single payments, while the administrative, maintenance, and management costs are usually a recurring fee, in general annually. Most investor related fee structures relate to the return of investment, with an average of 7.5% on the returned capital. In loan-based crowdfunding these fees are lower, where applied, in comparison to those in investment-based crowdfunding. On the other hand, administrative fees reach an average of 2.7% of applicable transaction costs.

Average fees charged to Investors:

- Administrative fees (Investor);

% on transaction cost: 2.70% - for Return of Investment (Investor);

% on capital: 7.50%

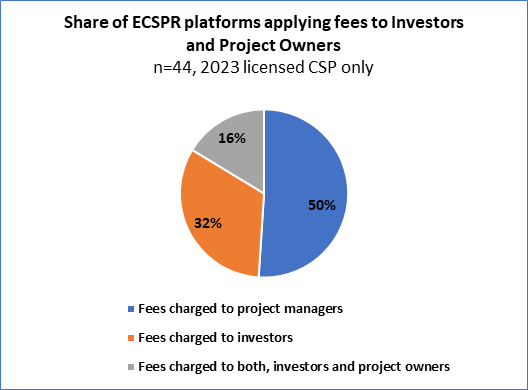

The average fees charged by the platforms within our data sample show that a mix of fee structures is applied and that platforms seek diversify their revenue by applying a variety of fees linked to different services and customers. The range of fees varies from platform to platform. Yet, our data shows that in 50% of all cases fees are directed to the project owners, either for the inclusion or closure of the operation if it has been satisfactory. To a lesser extent, 32% of commissions are directed to investors, relating to cost arising from operations, management, or account maintenance. Only in few cases do platforms charge in both cases (16%).

The variety in fee structures applied within the crowdfunding sector, makes it difficult to understand the cost of capital for project owners or investors on a general level for now. We can deduct however that the average cost of capital per fundraising will be, all inclusive, below 10% of capital. This is aligning with expectations compared to other capital market solutions, it however leaves room for adjustments with increasing economic activities and scale. Given that we estimate the deal Value in ECSPR transactions for 2023 to be above EUR 1bn, this would leave some EUR 100m in revenue, likely more, for a total of 106 licensed platforms at the end of 2023. An uneven distribution of revenue across platforms is to be expected with some performing better than others, alone because most platforms gained their license only in the second half of the year.

For 2024 we expect higher deal volumes and values, but margins will likely not change until platforms can create efficiencies of scale. However, significant is the number of platforms that does not share their fee structure. We believe that further development of the market will continue to pressure revenue models of crowdfunding platforms and that over time there will adjustments toward competitive, market driven approaches. Here the compliance cost of ECSPR and forthcoming regulations will be likely lead to a further concentration of the market.

Already today we can see the impact of cost on the development of a professional crowdfunding market, for example in Germany, where regulatory arbitrage has been enabled by the German government through a local law (Kleinanlegerschutzgesetz) that keeps cost lower for platforms and removes large parts of the investor protection inherent to ECSPR – and in contradiction to the name of the local law, which touts itself as the small investors protection law. According to ESMA in February 2024 only three platforms in Germany were ECSPR licensed, while the bulk of actors for now operates within the grey capital market without adequate oversight.