EUROCROWD’s July 2025 analysis of 236 licensed crowdfunding platforms across Europe, “ECSPR Compliance: Uneven Ground” revealed critical shortcomings in transparency and regulatory compliance under the European Crowdfunding Service Providers Regulation (ECSPR). Drawing on ESMA’s public register and standardized website reviews, our findings highlight both leaders and laggards in Europe’s crowdfunding ecosystem.

Key Numbers

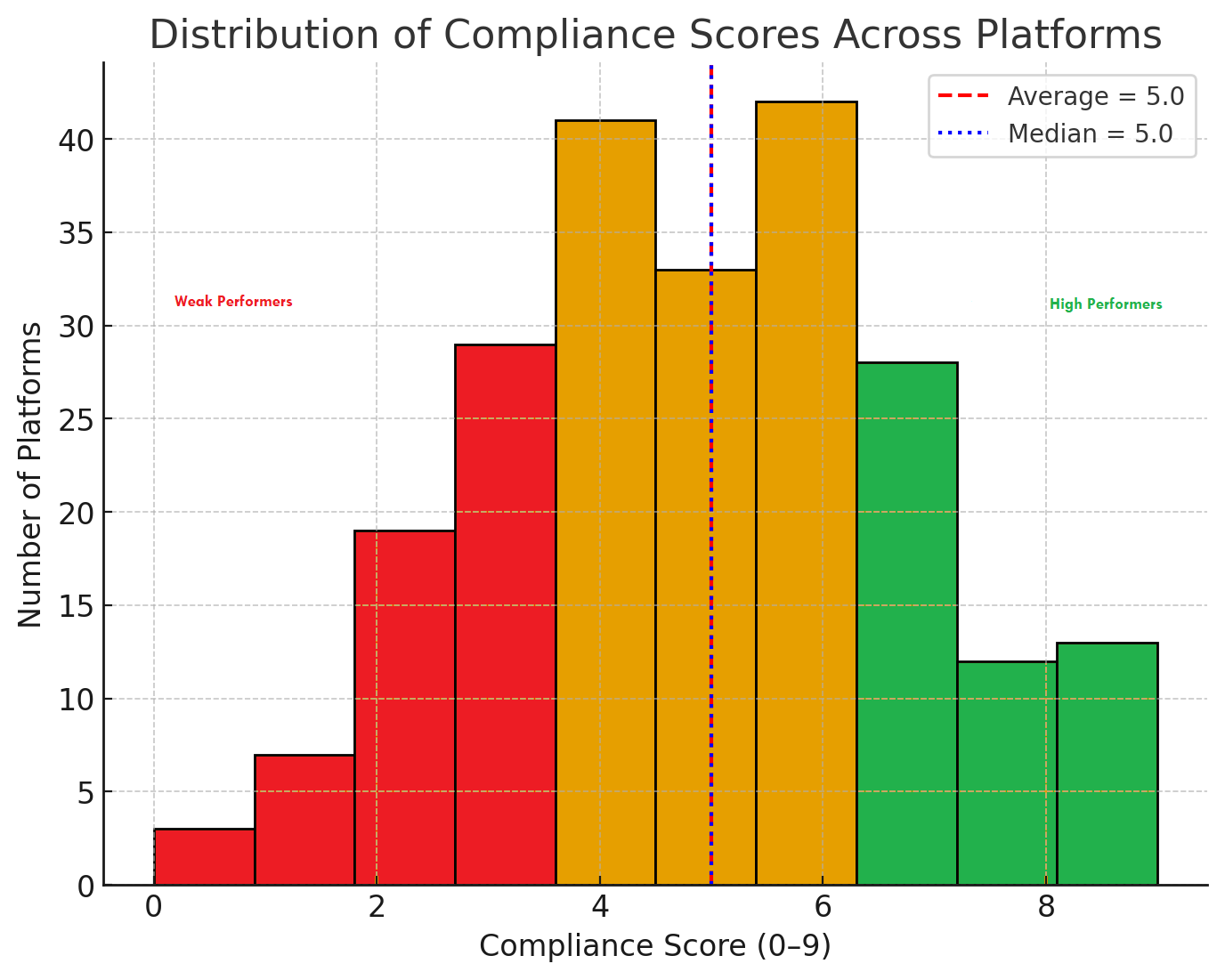

- Platforms evaluated: 236 (9 excluded due to no available data)

- Average compliance score: 5.0 (scale 0–10)

- Median score: 5.0

- Range: 0 (non-compliant) to 9 (highly compliant)

- Outlier country average: 7.0 (suggesting strong oversight or platform maturity)

- Four other countries: averages above 6.0, including the Netherlands

- 11 countries, incl. Spain and France: below 5.0 average

- Top performers: 3 platforms rated Excellent

- At risk: 29 platforms flagged for serious shortcomings

- Strong transparency adherence: 25% of platforms

- Failed baseline expectations: ~40%

Insights From the Data

Despite ECSPR’s goal of harmonisation, platform scores vary dramatically by country. Only one Member State reached an overall rating of Good. Most national markets averaged “Fair” or “Weak.” The few Excellent platforms appear to reflect strong internal governance rather than systemic oversight. “Excellence” does not cluster in specific jurisdictions.

Source: EUROCROWD

There are real gaps. Roughly three-quarters of platforms fail to disclose essential information such as leadership team details, governance structures, or project selection processes, leaving investors in the dark about accountability and risk management.

When it comes to investor focus, the market overall fails. Only a small minority report annual figures on funds raised, campaign outcomes, default rates, or investor returns. Without this, investors cannot benchmark risk or performance across the market. Add to this that nearly 40% of platforms scored below the minimum threshold, we might want to raise red flags for compliance and investor safety. Weak onboarding, vague risk disclosures, and patchy complaint-handling procedures compound these concerns.

In countries averaging below 5.0 we may fear systemic weaknesses in applying ECSPR. Without harmonised supervision and enforcement, market integrity risks remain high. The market has not been able to embrace the new EU regulation under ECSPR in a consistent manner.

Implications

- Platforms: High performers can differentiate through trust and transparency, while underperformers face growing reputational and regulatory risks. Expect increasing competition and consolidation. And, of course, litigation.

- Regulators: The uneven results underline the need for active supervision and harmonised reporting templates. Expect the development of regulatory leadership in a few markets, attracting additional CSP in those legislations over time.

- Investors: Careful platform and project due diligence remains essential. In crowdfunding investors have no say in deal structure and valuation, if platforms are not professional, investors’ money is at high risk. Publicly available compliance indicators should be factored into investment decisions. Be safe and only work with platforms rated at least 6.

ECSPR is a breakthrough for cross-border crowdfunding in Europe, but our data shows that significant transparency and compliance gaps remain across the board. Closing these gaps is vital to strengthen investor protection and to position crowdfunding as a credible pillar in Europe’s financial ecosystem.

EUROCROWD is now working with individual CSPs to identify areas of improvement and to help develop mitigation strategies to set individual platforms apart and to create leaders in the market. We will not have association with platforms that do not fulfil relevant pre-requirements. Given the data, we assume that 40% of current CSPs would be better off closing down, if they cannot quickly improve.