Our 7th Crowd Camp – Value Creation beyond Financial Returns on 16 – 17 June 2022 in Bilbao explores how professional crowdfunding will be able to create a bigger and lasting impact.

CrowdCamp will be key to understand how the crowdfunding sector is moving towards the practical implementation of the European Crowdfunding Service Provider Regulation (ECSP) and how the market is developing professional collaborations with ethical and sustainable financial market offerings.

Shifting European policies toward a greener and sustainable economy brings new challenges for both financial institutions and regional and local governments alike.

Panel 1: Best practices for incentivising ESG reporting

Environmental, Social, and Governance (ESG) is becoming a key focus for European business and financial services under the EU Green Deal. In this panel we will look at how different organisations are interacting with ESG monitoring and reporting frameworks within impact investing and sustainable development, and which (if any) key elements could be identified as replicable in crowdfudning.

Panel 2: Interconnecting private funding tools

Crowdfunding has come of age. At least politically and in regulatory terms, the business financing part of crowdfunding has not all the basic makings of a professional investment industry. This cannot be underestimated, as other alternative forms of finance, such as Business Angels, Microfinance or Venture Philanthropy Funds have no equivalent European recognition. This opens opportunities beyond simple co-investments for these sectors. ECSPR allows for sophisticated set ups using regulated investment funds to work alongside CSPs as co-investors, to allow retail investors to invest in loan portfolios and simplified deal structuring in cross border deals for private club deals. How can ECSPR become a game changer also for other alternative investment forms and is the market ready to exploit this opportunity?

Panel 3: Ethical finance and crowdfunding

The objectives set within positive impact and the use of money has a full meaning when there is a set of financing tools aligned by committed organisations. Strategies upon the typologies of projects to finance and also the activities to promote alternatives for a system change could be achieved thanks to crowdfunding/match-funding and ethical banking institutions working openly together. In this session we will overviewing different cases in which platform and ethical entities have a common path, taking into account aligned with specific goals. Which areas in the Social Economy could be reinforced within the financial mechanisms? How can the industry envision instruments that could set on a roadmap to face social, ecosystemic and environmental challenges?

Panel 4: Crowdfunding in the future of sustainable finance

As the EU Sustainable Finance Strategy provides increasingly detailed indications on which business activities can and should be considered “sustainable”, and it releases two separate reference documents (EU Green Taxonomy and Social Taxonomy), the alternative finance sector is still far from being able to meet such requirements. A number of gaps still remain, with these initiatives targeting only big capital providers on one hand, and big market players on the other. In this context, SMEs and startups, which constitute 98% of the EU economic tissue, struggle to find their place in the emerging sustainable finance landscape. The same condition remains valid for alternative finance providers such as crowdfunding platforms, who mainly provide capital to small ventures while mainly raising small amounts from large crowds of retail investors. How are crowdfunding platforms integrating sustainability aspects and do they align with EU requirements?

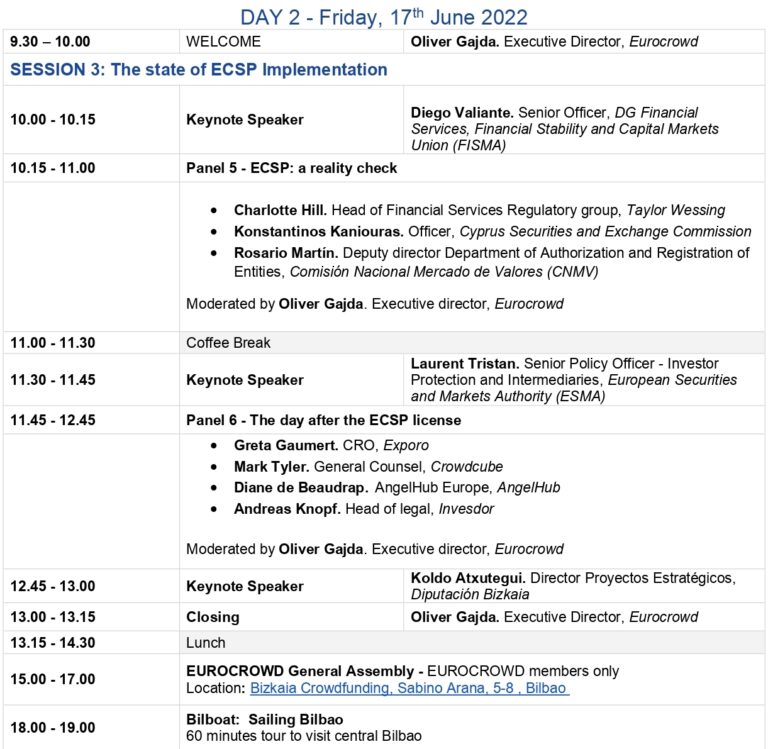

Panel 5: ECSP: a reality check

The implementation of ECSPR on national level has progressed with significant differences across the EU Member States. While in those Member States without existing crowdfunding regulation ECSPR is in effect since November 2021, in the others the transition period allowed for an adequate time to adjust operations for CSP with existing licenses. Yet, Member State policy makers have been slow to implement the European law and national conduct authorities have been partly very slow to engage with the industry. This has opened room for regulatory competition and a renewed fragmentation of the market. The panel will discuss problems and opportunities for Member State authorities in ensuring a professional and smooth transition to a European crowdfunding market.

Panel 6: The day after the ECSP license

Many CSPs have prepared since 2020 for ECSPR and were ready at the end of December 2021 to apply for the license. How is the situation in the middle of 2022 for those platforms that have been able to decide on a relevant Member State for their license application? And how deal CSP with national hurdles where an application is not or has not been possible. Can and is the market adjusting to political shortcomings for its own benefits?

Crowdfunding, now being a fully regulated and professional sector, is set to create significant additional impact and citizen engagement beyond institutional investments. Experts from crowdfunding platforms, policy-makers, regulators, law firms and other financial services sectors will elaborate the current challenges and opportunities: In which country is ECSP implemented? What are key differences and are some markets going to turn into hubs for innovative finance? How is ECSP implementation going to facilitate partnerships with other financial and governmental institutions? Will it also help create a more harmonized framework for sustainability requirements?

Speakers

Agenda and schedule

Panels